Don't Wait Until You Get OutStart Your Business TodayFinancial Support for Vet EntrepreneursBoost Your Vet-Owned Business CreditScholarship for Vet Business Owners

- Boost funding access with strong business credit

- Secure loans with improved business credit

- Higher loan approval & better terms

- Positive financial reputation

- Credibility boost with lenders

- Expand biz ops with improved cash flow

- Strong foundation for long-term success

This program was financially assisted

by the Fifth Third Foundation.

DEADLINE: MAY 25, 2025

Our Access to Capital program offers a comprehensive solution by providing a digital platform to help 10 veteran owned businesses build their business credit and get access to lenders.

Improved Access to Funding

Increased Credit Score

Enhanced Business Viability

More Attractive Loan Options

WHAT YOU GET

If you are one of the 10 selected, you will have access to our platform where you will be able to get the following…

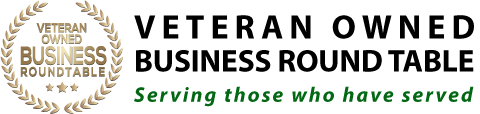

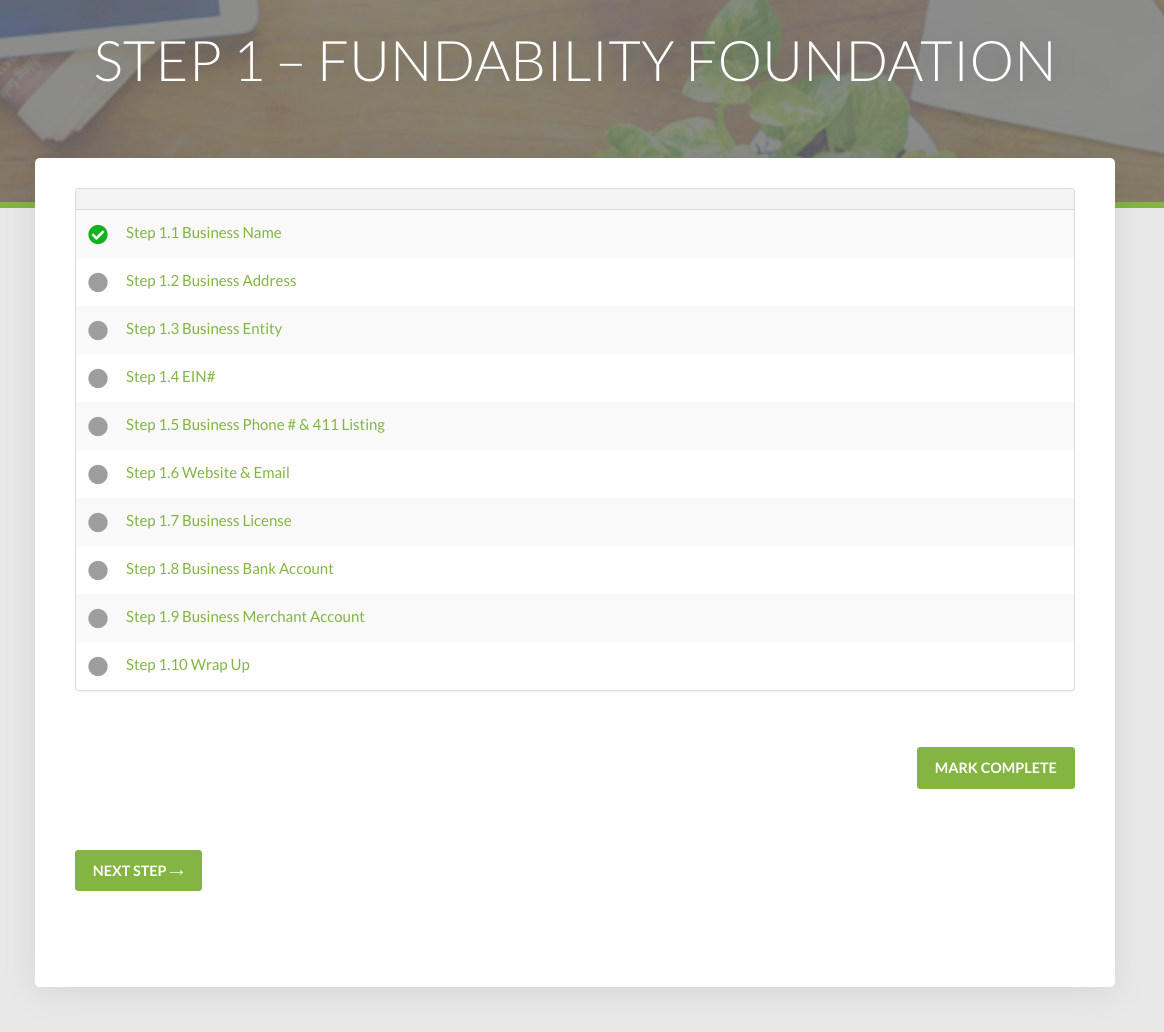

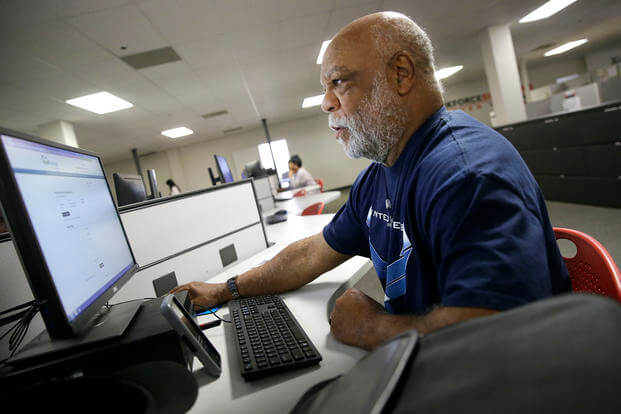

7 STEP PROCESS TO BECOME FUNDABLE

Our 7-step process to ensure business is fundable covers essential areas of credit building and financial management. From improving personal credit to establishing business credit, our process covers everything you need to know to secure funding and reach financial success. With the support of our dedicated business manager, you’ll be guided through each step to make sure your business is on the right track to funding.

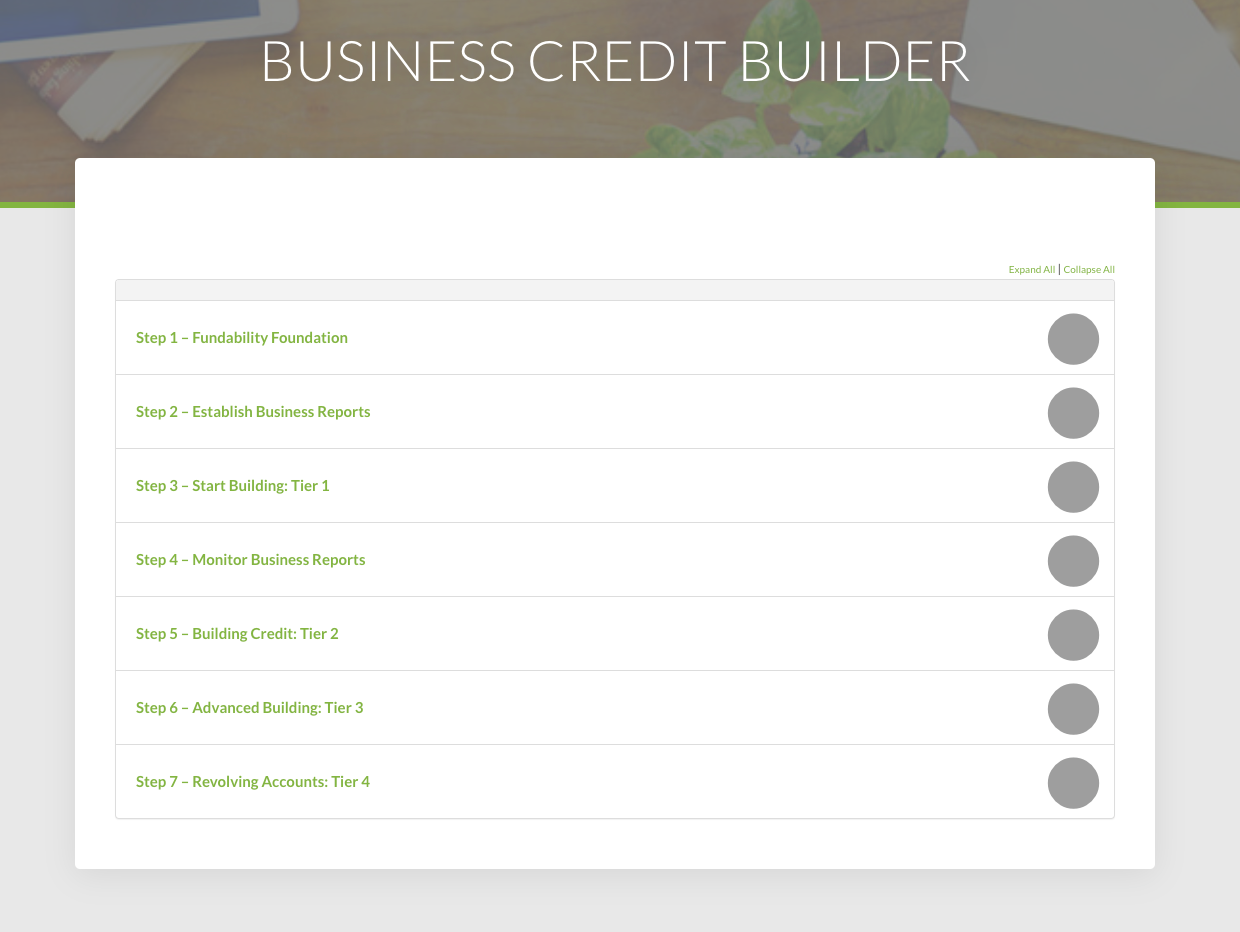

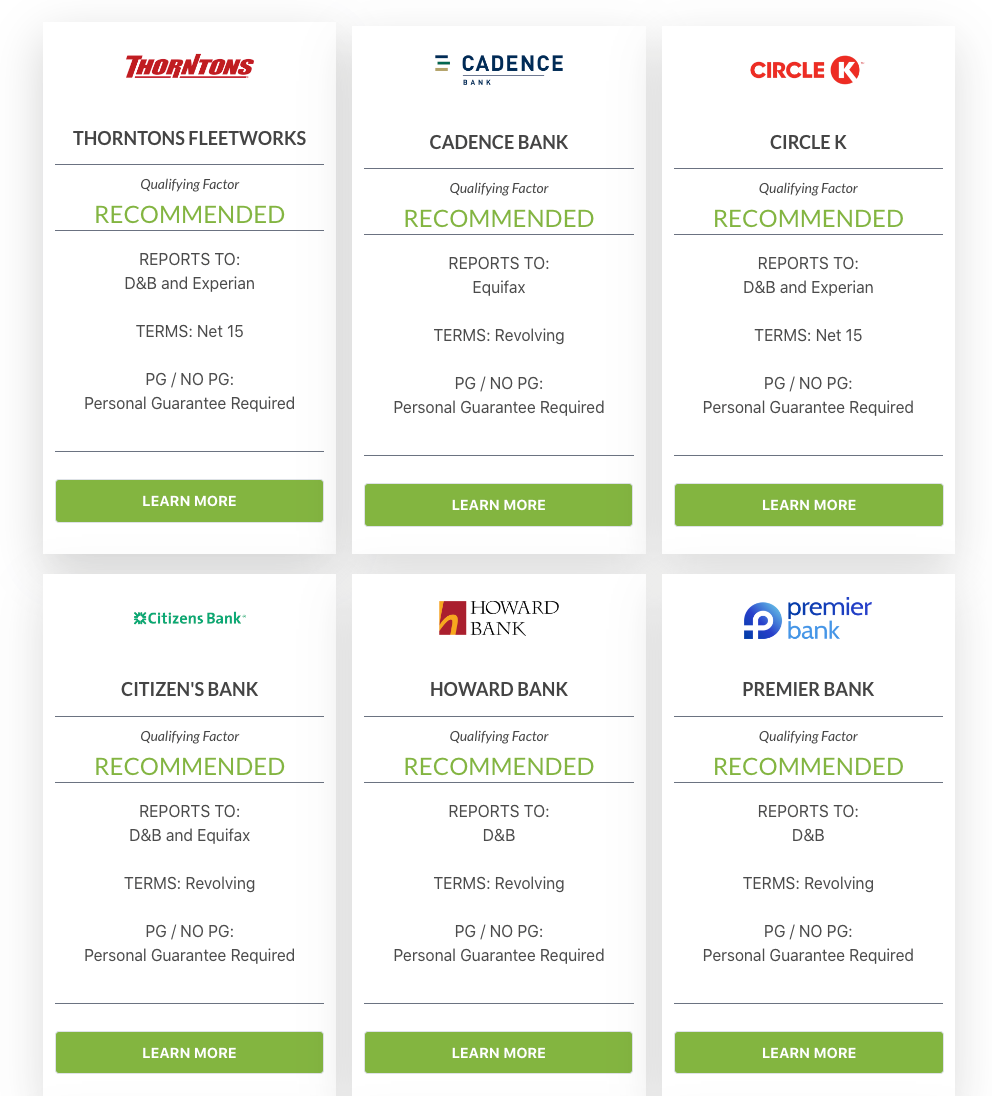

ACCESS TO LENDERS

With access to over 250 financial lenders, participants and grant awardees will have a wide range of financing and lending options available to them. Our system is constantly monitoring the participants business credit and notifies the participant when they qualify for a new credit line. This allows awardees to stay on top of their credit building progress and take advantage of new funding opportunities as they become available. With this level of support, building business credit has never been easier.

DEDICATED BUSINESS MANAGER

Participants and grant awardees of our Access to Capital program receive support from a dedicated business manager who will be in touch multiple times to ensure they acquire at least 12 credit lines within 12 months. This personalized attention helps to ensure that awardees are on track and making the most of the program’s benefits. With the support of their business manager, participants can feel confident in their ability to build their business credit and secure funding for their ventures.

We don't like to brag, but we're changing the game for veterans to be financially successful

“For us, the VOBRT’s "Access to Capital Program” provides a platform that fosters growth, secures vital resources, enables our company to reach new horizons in the marketplace and unlock newfound opportunities. It will equip our company with the resources necessary to thrive and contribute to the community.”

Doug DiCamilloU.S. Army, D2 CONNECTIONS, LLC

“The Access to Capital program was a game-changer for my veteran-owned business. With the support of the dedicated business manager and access to multiple lenders, I was able to secure 12 credit lines within 12 months and take my business to the next level.”

Kara LucasU.S. Army,

Interior Decorator

“As a veteran business owner, I was skeptical about programs like this, but the Access to Capital program exceeded my expectations. My business credit score has improved dramatically, and I now have access to funding that was previously out of reach.”

Gregory DavisU.S. Army, Davis Farms

Now you don't have to worry about how to build your business credit.

We are going to show you step-by-step!

MEET OUR JUDGES

The judges of the Veteran Access to Capital scholarship are a panel of experienced business professionals and veteran who are dedicated to helping veteran-owned businesses succeed. With a deep understanding of the challenges faced by veteran entrepreneurs, they bring a wealth of knowledge and expertise to the selection process.

John is a Visiting Executive at the University of Washington's Michael G. Foster School of Business and a sought-after advisor for his leadership counsel and growth perspective, particularly for minority businesses. He has held senior management and board positions in banking, venture capital, manufacturing, and logistics. John holds an MBA in economics and corporate finance, a Bachelor's degree from the University of Washington's Foster School of Business, and is a former US Marine.

ELIGIBILITY

ELIGIBILITY & CRITERIA

We are looking for veteran owned businesses

To be eligible for our Access to Capital program, you must meet the following qualifications:

- Must be a verified/certified veteran-owned business

- Must be in good standing with no outstanding legal or financial issues

- Must have a minimum of 6 months in business

- Employer Identification Number (EIN) (Tax ID),

- Dun and Bradstreet / DUNS#

- Have a Business Checking account

- Must provide accurate and up-to-date business and personal information

- Must be willing to participate in the 7-Step process and work with a dedicated business manager for up to 12 months

- Must comply with all program requirements and follow the guidelines set forth by the program

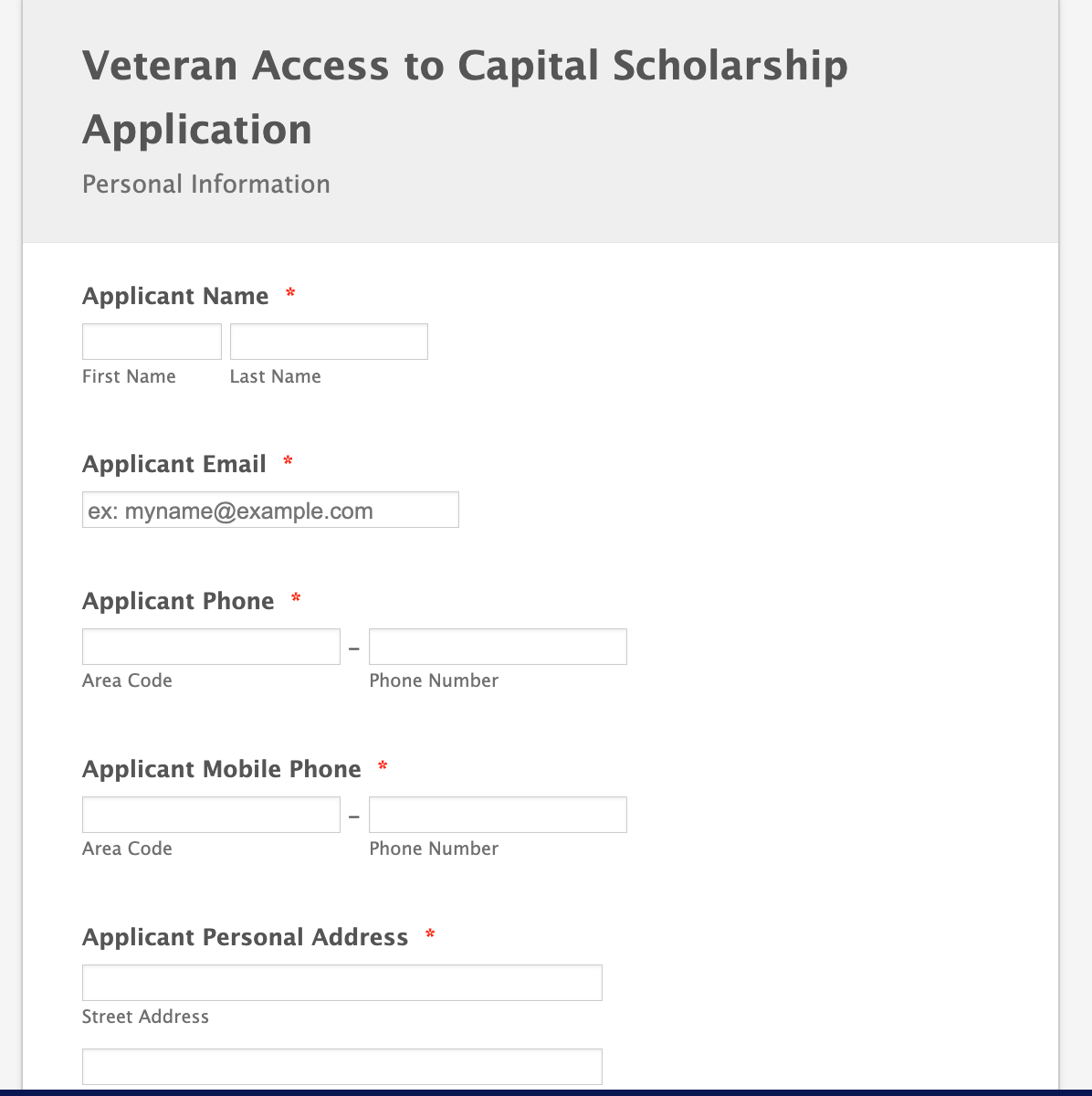

HOW TO APPLY

ELIGIBILITY & CRITERIA

It's easy to apply and will take you ONLY 10 minutes

To apply for our Access to Capital program, follow these simple steps:

- Make sure you have read the entire website and learned about the program and its benefits.

- Click on the “Apply Now” button to access the application form.

- Fill out the form completely with accurate and up-to-date information about your business and personal details.

- Submit the application and submit any supporting documentation that may be required.

- Our team will review your application and get back to you with a decision shortly after the deadline.

- If approved, you will receive access to the backend portal and will be able to start taking advantage of the program’s benefits.

Note: Requirements and application process may vary, so be sure to check our website for the most up-to-date information.

Don't wait any longer!

Get access to the financial resources you need for your veteran owned business.

The Veteran Owned Business Roundtable’s Access to Capital program is a critical initiative aimed at providing veteran-owned businesses with the financial resources they need to start and grow their businesses. The program’s comprehensive approach, which includes partnerships, education and training, and support networks, is designed to help veterans overcome the challenges they face when trying to secure funding.